|

| Balik Pulau (in Pulau Pinang) 1 |

|

| Balik Pulau (in Pulau Pinang) 2 |

|

| Batu Cave (in Selangor) |

|

| Botanic Garden in Malacca |

|

| Botanic Garden in Pulau Pinang |

|

| Waterfall at Gunung Ledang (in Johor) |

|

| Waterfall at Gunung Ledang (in Johor) |

|

| Balik Pulau (in Pulau Pinang) 1 |

|

| Balik Pulau (in Pulau Pinang) 2 |

|

| Batu Cave (in Selangor) |

|

| Botanic Garden in Malacca |

|

| Botanic Garden in Pulau Pinang |

|

| Waterfall at Gunung Ledang (in Johor) |

|

| Waterfall at Gunung Ledang (in Johor) |

It has been a while since I last read a physical book on personal finance. Today, I am going to share my review on a book that I've just completed - The A to Z Guide To Retirement Planning (2016), by a local author, Patrick Chang.

I got to know Patrick via social media for one year plus, finally we managed to arrange for a kopi session last month and gotten a copy of this autographed book from him.

The book breaking down the gigantic topic of Retirement Planning into 26 chapters (hint hint from the book title :-)), make it easier to digest and readers can pick and choose whichever topics of their interest to "wallop" first as each chapter can be consumed individually. For me, I approach it systematically i.e. literally from A to Z....

It covers practically all the thinkable topics related to retirement planning (from cashflow, budgeting, insurance to various investment schemes etc.) and provide plenty of local use cases or examples from his own experiences as Certified Financial Planner. Besides the evolving National Schemes like Medishield Life and CPF Life, most (if not all) of the topics are ever-green.

Of course, for a small book like this (170 pages to be exact), it only cover high level broader view of each topic and not dwelling into much details. So, for veteran, this book might seems to be too basic. Having said that, I find that it provides a very comprehensive view of areas that we need to take into consideration when come to Retirement Planning. So, it is very suitable for the newbie or beginner in the retirement planning (regardless of your age).

Oh by the way, Patrick is also the founder of the Affluent - The Wealth Management Game card game. Do check it out if you are a physical card game fan. Sneak peak : the last I heard from him is that he is brewing something new on this brainchild of his. So, stay tuned!

Cheers!

|

| Image Source: Unsplash |

|

| Image Source: Unsplash |

HAPPY BIRTHDAY SINGAPORE!

On last Friday, we've received some good news in relation to the Covid-19 measures in Singapore. Soon (from 10 Aug 2021, Tue to be exact), Singapore will gradually relax the Covid-19 measures and the Government has also list down 4-stages of reopening (from Stage 1 of preparation to Stage 4 of Covid-Resilient Nation i.e. the "new normal"). Overall, it is a positive sign for the residents as we are finally seeing the light at the end of the tunnel.

Having said that, we all still need to remain vigilant, continue to wear masks, maintain personal hygiene and most importantly, get yourselves vaccinated, if you have not done so (unless your situation do not allow you to do so). I am very hopeful about the road ahead of us as I am sure we will win this "war"! Also, I hope we can start to travel again (for leisure) by end of the year or beginning of next year.

Today is also the last day of Olympic 2020 (Tokyo) and it looks like United States will top the medals table with 113 medals (table below is as accurate at 3PM today):

|

| Olympic 2020 - Medals |

When my wife saw me holding the book (Simply Invest - Naked Truths To Grow Your Money) from afar, she made a casual comment “Eh, this book title look like your blog title”. I was like “…..” lol

Anyway, joke aside, just completed reading this 2019 book by Goh Yang Chye. Even though it doesn’t really provide any new ground/perspective, at least to me, but it is still a pleasant read with its emphasis/highlights on some of the salient points about investing eg.

“Focusing on time in the market instead of ‘timing the market”

“Invest for the long term”

“The importance of psychological biases”

“Market work in cycles” etc…

It doesn’t dwell very in-depth in each topic but sufficiently hit the points with relevant context like market history, charts and research results etc. Also, the book do promote certain way/style of investing (ie index/portfolio investing vs individual stock picking) which might not be aligned with all seasoned investors, so, do read it with an open mind.

P/S : I quite like the tile of this chapter “The ways we fool ourselves”

As we are back to Phase 2 Heightened Alert now, stay safe and stay healthy!

Cheers!

For the last 2 years, the world has been gripped by a pandemic, which has wreaked havoc around the world and for many small investors, volatile markets mean liquidating wealth and storing it in precious metals is a smart move in 2021.

|

| Image Source : Freepik |

Here is some information about the rarest precious metals that people are buying in 2021.

1. Rhodium - This is the rarest precious metal on the planet that is a noble metal in the platinum family and the main usage of Rhodium is in the manufacture of catalytic converters, which are found on all modern automobiles. If you wanted to acquire one kilogram of this very rare element, it will cost you more than $600,000 and about 30 tons are mined annually.

2. Iridium - Another platinum metal, iridium is the second densest metal, behind osmium, which was first discovered in 1803, when a scientist looked carefully at some platinum residue. The metal is used to make high-performance spark plugs, as the metal retains its properties at very high temperatures. To give you some idea of its rarity, iridium is 40 times rarer than gold and if you wanted to get your hands on one kilogram, it would cost a cool $100,000.

3. Gold - Gold has always been the very foundation of global health since time began. Now is the ideal time to acquire gold as an investment and with a Google search, you can find a nearby reputable gold bullion dealer. When buying gold, you should always take physical possession and wherever you live, you are never far away from a recognised gold bullion dealer who can be found with an online search. At the current prices, it would cost you $58,000 for a kg of pure gold and with prices rising, now would be a good time to buy that much gold. Have a look at the gold Adelaide investors get from City Gold Bullion.

4. Palladium - Another silvery metal from the platinum family of metals, palladium is primarily used in the making of catalytic converters, a device that turn toxic emissions into less toxic materials, essential for reducing global pollution. The annual production is around 220 tons and at just over $77,500 per kg, this is an expensive and rare precious metal.

5.

Ruthenium - Yet another metal from the platinum family,

ruthenium is inert to almost all other chemicals and cost around $9,000 for a

kg. This metal is used in the making of certain alloys and to make very

resistant electrical contacts, while it is also used as a chemical catalyst.

Ruthenium is found in ore and both North and South America have traces of this

metal.

If you would like to invest in precious metal, gold is the safest commodity, especially during these troubled times and a Google search will help you to locate a reputable gold bullion dealer who has offices close to your home. Gold has performed well during the pandemic, as many investors made the switch to gold, which is less risky than other investments.

Last week, I've successfully injected additional S$6K into Syfe REIT+ portfolio (I've chosen the 100% REIT allocation option and not the ARI, Automated Risk-managed Investment option in view of the small size of my fund). The Syfe REIT+ portfolio is closely replicate the performance of the SGX iEdge S-REIT Leaders Index (which cover about 10 high quality REITs in Singapore). Also, it offer the feature to re-invest the dividend automatically into the portfolio, which is perfect.

My intention is to leave the fund here for longer term, I will review the performance again (probably in a couple of months) and decide whether to further inject new fund into this portfolio.

If you are keen to explore this platform, do feel free to use my referral code of SRPTG2S4L to enjoy the fee waiver of up to 6 months on first S30,000 investment.So, this post is to share my experience thus far on each of these platforms. The 3 platforms that I will be touching on are :

1. Syfe - Started since Dec 2020 (for my cash investment)

2. StashAway - Started since Dec 2020 (for my SRS investment)

3. Endowus - Started since Mar 2021 (for my CPF-OA investment)

Note: a. As I am investing varying amounts in each of these platforms, so I will indicate their performances in % for better comparison. b. I've chosen the portfolio with "higher return potential" in all my initial investments.

a. App experience: The App's UI is sleek and easy to use. The App UI has been slightly revamped recently, once you get the hang of it, it's easy-peasy. Also, the funding/deposit process is quite straight-forward, for depositing from local banks, you can use either PayNow (via UEN) or FAST/GIRO transfer via Internet Banking.

b. Investment details: You can select from a few of the predetermined core portfolio i.e. Core Growth (my choice), Core Balanced, Core Defensive, Cash+ or REIT+ (latest addition). Once you've chosen the portfolio (you can choose multiple portfolio for your investments), you will be able to see the actual funds/stocks purchased and the fees paid (if any) upon clicking into the portfolio.

c. Investment Performance (from Dec 2020 till Mar 2021): 5.74% (Time weighted Return)

d. Other Useful Stuff: The same App contain Knowledge (or educational) section covering Guides, Advices, Magazines and even Webinars on anything and everything about personal investing.

e. My take so far: I am quite happy with my experience so far and the next portfolio that I will be interested to explore further is their REIT+ portfolio. If you are keen to explore this platform, do feel free to use my referral code of SRPTG2S4L to enjoy the fee waiver of up to 6 months on first S30,000 investment.

a. App experience: The App's UI is slightly more complicated but still not difficult to maneuver around. As I am in vesting my SRS amount in this platform, I just need to link my SRS Account and indicate the amount to begin my investment. For cash investment, the funding/deposit process is quite straight-forward, for depositing from local banks, you can use either PayNow (via UEN) or bank transfer via Internet Banking.

b. Investment details: You can select from a few of the predetermined core portfolio i.e. General Investing (my choice), Goal-Based Investing or Income Portfolio. Once you've chosen the portfolio (you can choose multiple portfolio for your investments), you will be able to see the actual funds/stocks purchased and the fees paid (if any) upon clicking into the portfolio.

c. Investment Performance (from Dec 2020 till Mar 2021): 6.63% (Time weighted Return)

d. Other Useful Stuff: The same App contain Academy section covering videos and articles as well as upcoming events on anything and everything about personal investing.

e. My take so far: I am quite happy with my experience so far and I will consider continue to invest my SRS fund in this platform going forward. If you are keen to explore this platform, do feel free to use my referral code here to enjoy the fee waiver of up to 6 months on first S10,000 investment.

a. App experience: As I need to complete the "ABS-SAS eLearning Module for Unit Trusts and Investment-Linked Insurance Products" and upload my certificate online once I passed, it took me ahile before my onboarding process is finally completed in Mar 2021. The App's UI is clean and professionally look, not difficult to maneuver around. As I am investing my CPF-OA amount in this platform, I just need to link my CPF-OA Account and indicate the amount to begin my investment. For cash investment, the funding/deposit process is quite straight-forward, for depositing from local banks, you can use either PayNow (via UEN) or bank transfer via Internet Banking. So far, this is the only robo-advisor platforms (among the three) that allow the source of fund from Cash, SRS and CPF-OA.

b. Investment details: You can select from a few of the predetermined core portfolio i.e. General Wealth Accumulation (my choice), Cash Smart, Fund Smart. Once you've chosen the portfolio (you can choose multiple portfolio for your investments), you will be able to see the actual funds/stocks purchased and the fees paid (if any) upon clicking into the portfolio.

c. Investment Performance (from Mar 2021 till Mar 2021): 1.52% (Time weighted Return)

d. Other Useful Stuff: N.A.

e. My take so far: I am still monitoring the performance of this portfolio as it is too early to assess at the moment. If you are keen to explore this platform, do feel free to use my referral code here to enjoy the fee waiver of up to 6 months on first S10,000 investment.

Are you investing with any of the abovementioned Robo-adviser? What is your experience so far?

Cheers!

|

| Patient tag at the hospital |

|

| The "hole" that I will remember for life! |

At the same time, I am also curious how long will it take for such transfer (it is not instant) and how much will it cost (not all is free) for each of the transfer?

Following are my findings:

1. For Ethereum (ETH) : took 8 minutes and cost me USD0.28 per USD100 (network fee)

2. For Litecoin (LTC) : took 3 minutes and cost me USD0.00 per USD100 (network fee)

3. For Bitcoin (BTC) : took 27 minutes and cost me USD0.13 per USD100 (network fee)

How I track the response time is based on the email notifications from Coinbase (the sending time) and Binance Sg (the receiving time).

From the above experience, the cheapest (free) and fastest crypto is Litecoin, the most expensive transfer is Ethereum (surprise, surprise, surprise) and the slowest is Bitcoin.

Of course, comparing to the traditional international fund transfer like West Union, the speed and cost of crypto transfer is still much cheaper.

What is your experience of crypto transfer so far?

Cheers!

There are ample signs and symptom prior to this, my weight has been in declining mode for the past few months and physically it is quite obvious (at least from friends and relatives). High level estimate, I have lost more than 6 kg within 3 months.

Last week, after an episode of vomiting and stomach discomfort, went to my GP and upon further blood test, I've been officially a Type 2 Diabetes patient (based on the recent report, 10.5% of Singapore population are diabetics, so ya, I am part of the statistic now). With my recent weight loss and the family history, it is not really a surprise.

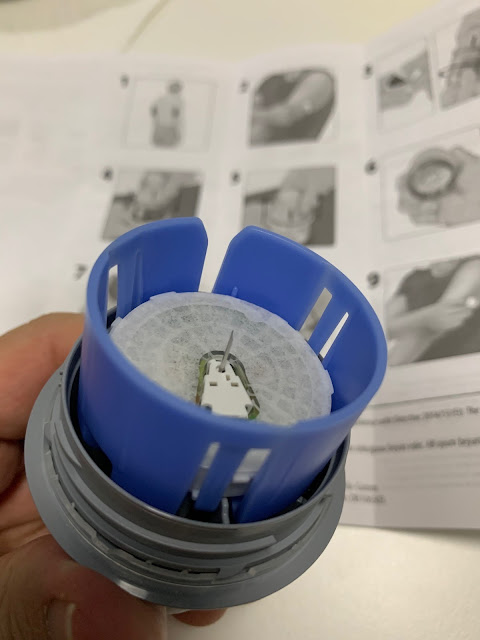

Immediately, what will be changing is my diet and close monitoring of my glucose level. I used to have sweet tooth (guess it play a major part here) and now will need to overhaul the food intake/variety. For monitoring my glucose level, thanks to the technology, I am able to track it by scanning instead of pricking via the Freestyle Libre device. It is easy to administer and totally painless too.

|

| Freestyle Libre pack |

|

| Freestyle Libre applicator (the real stuff) |

Also, I've started the Diabetes medicine with immediate effect and due for a follow-up with the doctor sometime in Feb 2021. Well, life goes on and I will continue to do my weekend hiking/trailing where possible.

Wealth is great; Health is much better! Never too late to say this...

Cheers!

Happy New Year 2021 to ALL!

On my investment front, I've sold off all my DBS and OCBC shares recently with some small profit. Next, will be focusing on putting some fund in the lesser effort avenues like the Syfe (Referral Code : SRPTG2S4L) and StashAway platforms and let the professionals (or the robots) do the job on my behalf. Just completed the onboarding process not long ago and deposited some funds to try out the platforms. Let's see how it goes.

I am also looking at Endowus platform to park some of my CPF fund but find that its onboarding process is much more complicated than the other two i.e. it requires me to take some online self-test in order to complete the registration. I guess it will take a while before I will complete the online test.

On the personal front, 2020 is a year of ZERO oversea travel for us, except for our recent year-end "oversea" staycation at Sentosa. 2020 is also a year of LESS is MORE. Thanks to the Covid-19, most (if not all) of us spend less time physically with others but it also created opportunity for us to spend MORE time with those really close/dear to us.

Covid-19 Vaccination administration has been kicked-off across the globe and hopefully we will soon be back to the new normal. Meanwhile, let's continue to stay vigilant and maintain the proper social distancing measures.

If everything goes well, I hope we can travel leisurely again in 3rd or 4th quarter of 2021.

Cheers!